A new operating model for Oikocredit [interview]

November 27 | 2018

November 27 | 2018 Earlier this year, Oikocredit introduced its updated strategy. Bart van Eyk, Oikocredit’s Director of Investments, shares the latest details of our updated strategy and explains how changes to our regional setup will help us to better serve our partners with the aim of creating an even stronger social impact.

What are the latest changes taking place as part of the updated strategy?

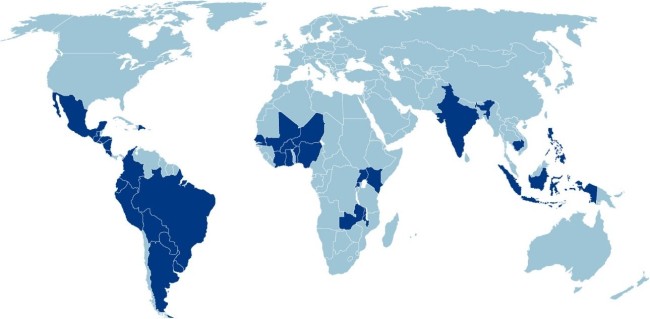

A few months ago, we introduced our updated strategy to our global network. We announced that we would focus our efforts on 33 growth countries going forward across our three regions of Latin America and the Caribbean, Africa and Asia. We also shared that we will continue to work in our focus sectors of financial inclusion, agriculture and renewable energy.

This month, we released our updated Vision and Strategy brochure, which shares our direction and aims for the next five years.

In our updated strategy we have set ourselves ambitious goals, such as doubling the number of end-borrowers we reach directly to 2.3 million, and supporting our partners to create and sustain over 500,000 jobs by 2022.

To achieve these goals, we have defined how we will work and where we will have a local presence. This means we will be making some changes to the way we organise ourselves, as well as working to improve our processes.

How will these changes affect Oikocredit’s local presence?

When we designed the new setup it was very clear that to be successful in delivering the social impact we’re aiming for, we need to continue to be close to our partners and have feet on the ground. However, in the past we have been too thinly spread across many smaller offices. It’s important that we’re strategic about our local presence so that we can deliver on our ambitions.

This means that we are going to close or merge some of our offices. To decide which offices would best serve the needs of each region, we considered a range of factors including the growth potential of the market, and convenient connections to current and future partners in our growth countries. It’s also important that our offices have a certain scale so that we can make best use of our resources and take advantage of opportunities for staff to share their knowledge and expertise to the benefit of our partners.

Following these changes, we will make changes to the setup of our central office in the Netherlands so we can continue to support the work of our country and regional offices in the best possible way.

This new model unfortunately means that a number of positions will be made redundant. We’re committed to treating our staff with the greatest respect and care, and we’re working closely with affected employees to offer support in this period of change.

What will Oikocredit’s local presence look like in the future?

By the end of 2019 we plan to have offices in 14 locations across our three regions of Latin America and the Caribbean, Africa, and Asia. We will serve all of our 33 growth countries [see map below] from these locations.

This will include three regional offices, one for each region.

Offices affected by changes are being merged or closed gradually. Please refer to our website for up to date information about our office locations.

We will still have the largest number of local offices compared to our peers.

Will there be any changes for Oikocredit’s partners?

We will continue to serve and welcome new and existing partners in all 33 growth countries across our three regions. If a country office closes, partners in that country will be served from another office close by in the same region. Partners will be informed in good time of any changes to local offices that affect them.

Our new setup will be even more client-centric, putting our partners first. By consolidating administrative and central functions in our regional offices as much as possible, staff in our country offices will be able to focus fully on serving our partners.

Why are these changes happening?

In updating our strategy, we set out to answer two key questions: where should we focus our efforts, and how can we do that most effectively?

First of all, and most importantly, we started with our mission. Oikocredit has been around for 43 years now, and we have been very successful. Over time, we have grown significantly into an organisation with a portfolio of around € 1 billion today, and we’ve been a pioneer in our industry.

Our mission is still relevant. We have ambitions to almost double our portfolio over the next five years, and we want to go further still by sharing our networks and expertise to become a catalyst for even greater social impact.

But in the time since Oikocredit started, the industry has grown and changed. We’ve been challenged in recent years by increasing competition and the low-interest-rate environment, which has made it more difficult to make returns from providing loans. At the same time, as happens with many organisations that grow rapidly, our structures and processes have grown more complex over the years.

The large number of offices we have across the world also mean our costs are higher than those of others in the industry, as our Director of Finance shared recently.

We are now adapting to these changing conditions by making choices about which countries we will operate in and where we will have offices. By organising ourselves differently and improving our processes, we aim to realise the growth ambitions in our updated strategy.

Social impact is at the heart of Oikocredit’s work. How are these changes aligned with Oikocredit’s values?

Our values are driving these changes. At the beginning of the strategy review, we defined an ambition statement which really brings things back to the core of what Oikocredit stands for and reminds us what makes Oikocredit special. To be successful in delivering our mission we have also been explicit about our ambition to be catalysts for change in our industry.

I am confident that our new model strikes the right balance between the scale we need to make best use of our resources, and the local presence that is so important to us. This new setup means we can sharpen our focus on what is most important: supporting our partners to create social impact.

How will these changes benefit the people we work for: our partners and their clients?

We will continue to deliver our core products of loans, equity and capacity building for our partners. Capacity building is one place where we really go the extra mile for our partners by helping them to develop and strengthen the skills they need to meet their own business goals. We aim to provide even more partners with capacity building in the future.

Everything we do is ultimately for the benefit of partners and the people they serve, which is what our investors want us to focus on. By being strategic about our presence, I am confident we can significantly increase our reach and our impact.

After many years of success, we are taking the time to lay the foundations and set the direction for the next phase of growth. We look forward to playing an even bigger role in improving the lives of low-income people for years to come.

Read more about Oikocredit’s updated strategy here.

Archive > 2018 > November

- November 29 | 2018 11/29/18, 2:19 PM - Call for Oikocredit Supervisory Board applications

- November 27 | 2018 11/27/18, 11:30 AM - A new operating model for Oikocredit [interview]

- November 26 | 2018 11/26/18, 9:52 AM - Investors and volunteers visit Oikocredit partners in Peru

- November 20 | 2018 11/20/18, 1:09 PM - Turning organic waste into energy: how Oikocredit offsets its carbon footprint

- November 13 | 2018 11/13/18, 10:00 AM - Preserving the future of cocoa in Côte d’Ivoire

- November 05 | 2018 11/5/18, 10:25 AM - Wool with a name